In the short term, over time, stock markets tend to go higher. This makes money attractive. But if you choose that option, you will buy stocks that fail the market. In the last year Opinions of the company Travel + Leisure Co. (NYSE:TNL)’s share price is up 27%, but it’s dwarfed by the market’s return. Long-term holders, on the other hand, have been on a roll, with the stock down 19% in three years.

Since the stock has added US$146m to its market cap in the last week alone, let’s see if that trend has resulted in long-term returns.

Check out our latest Travel + Leisure review

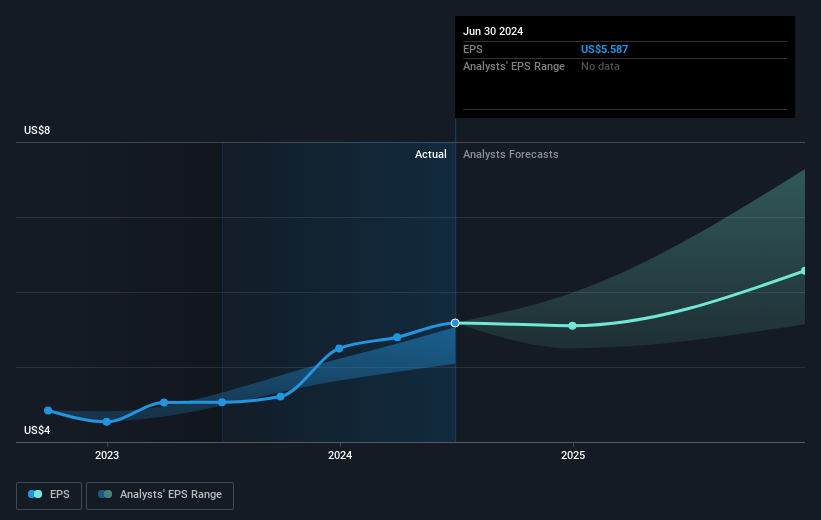

There’s no denying that markets are sometimes useful, but prices don’t always reflect the direction of a business. One crude but common way to see how sentiment on a company has changed is to compare earnings per share (EPS) to share price.

Travel + Leisure was able to grow EPS by 23% in the last twelve months. This EPS growth is close to a 27% increase in share price. This shows that the market sentiment surrounding the company has not changed much during that time. It seems that share price is responding to EPS.

The company’s earnings per share (period) is shown in the chart below (click to see actual numbers).

We know that Travel + Leisure has changed a lot over the past three years, but what does the future hold? If you’re thinking about buying or selling Travel + Leisure stock, you should check this out FREE detailed report on its website.

What About Dividends?

In addition to measuring the return on share price, investors should also consider Total shareholder return (TSR). While the return on share price only reflects the change in share price, the TSR includes the value of dividends (assuming they have been repaid) and the benefit of the promotion of any discount or adjustment. It is fair to say that the TSR provides a comprehensive picture of the stocks that provide the dividend. We note that Travel + Leisure’s TSR over the past 1 year was 33%, which is better than the return on share price mentioned above. And there’s no reward for assuming that the wage distribution explains the difference!

A Different View

Travel + Leisure’s TSR for the year was in line with the market, at 33%. That return looks impressive, and is better than the five-year TSR of 5% per year. Even if the price growth slows down from here, there is a chance that this is a business worth watching in the long run. I find it interesting to look at the stock price over the long term as a business project. But in order to gain real insight, we need to consider some facts. For example, consider a financial risk that is always present. We have identified two warning signs and Travel + Leisure (at least 1 is important), and understanding them should be part of your investment plan.

Where Travel + Leisure may not be the best store to shop. Then you might want to check this out free collecting growth stocks.

Please note, the information mentioned in this article reflects the number of stocks currently trading in the American market.

Counting is hard, but we’re here to make it easy.

Find out if Travel + Leisure can be limited or reduced with our detailed analysis, where it is valuation, potential risks, profits, insider trading, and financial position.

Access Free Analysis

Have a comment on this article? Worried about content? Contact each other and us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is more general in nature. We provide reviews based on historical data and expert forecasts using unbiased methods and our articles are not intended to be financial advice. It does not make recommendations to buy or sell any stock, and does not take into account your goals, or financial situation. We want to bring you long-term analytics driven by meaningful data. Note that our analysis may not be influenced by recent company announcements or stock prices. Simply Wall St has no position in any of the listed stocks.

#Travel #Leisures #NYSETNL #return #outpaced #companys #earnings #period